Important

You are browsing upcoming documentation for version 7.0 of OroCommerce, scheduled for release in 2026. Read the documentation for the latest LTS version to get up-to-date information.

See our Release Process documentation for more information on the currently supported and upcoming releases.

Configure Global Tax Calculation Settings

Hint

This section is part of the Tax Management concept guide that provides a general understanding of the tax configuration and management in OroCommerce.

By default, OroCommerce calculates tax using a rate defined in the built-in tax rule for the default shipping origin address.

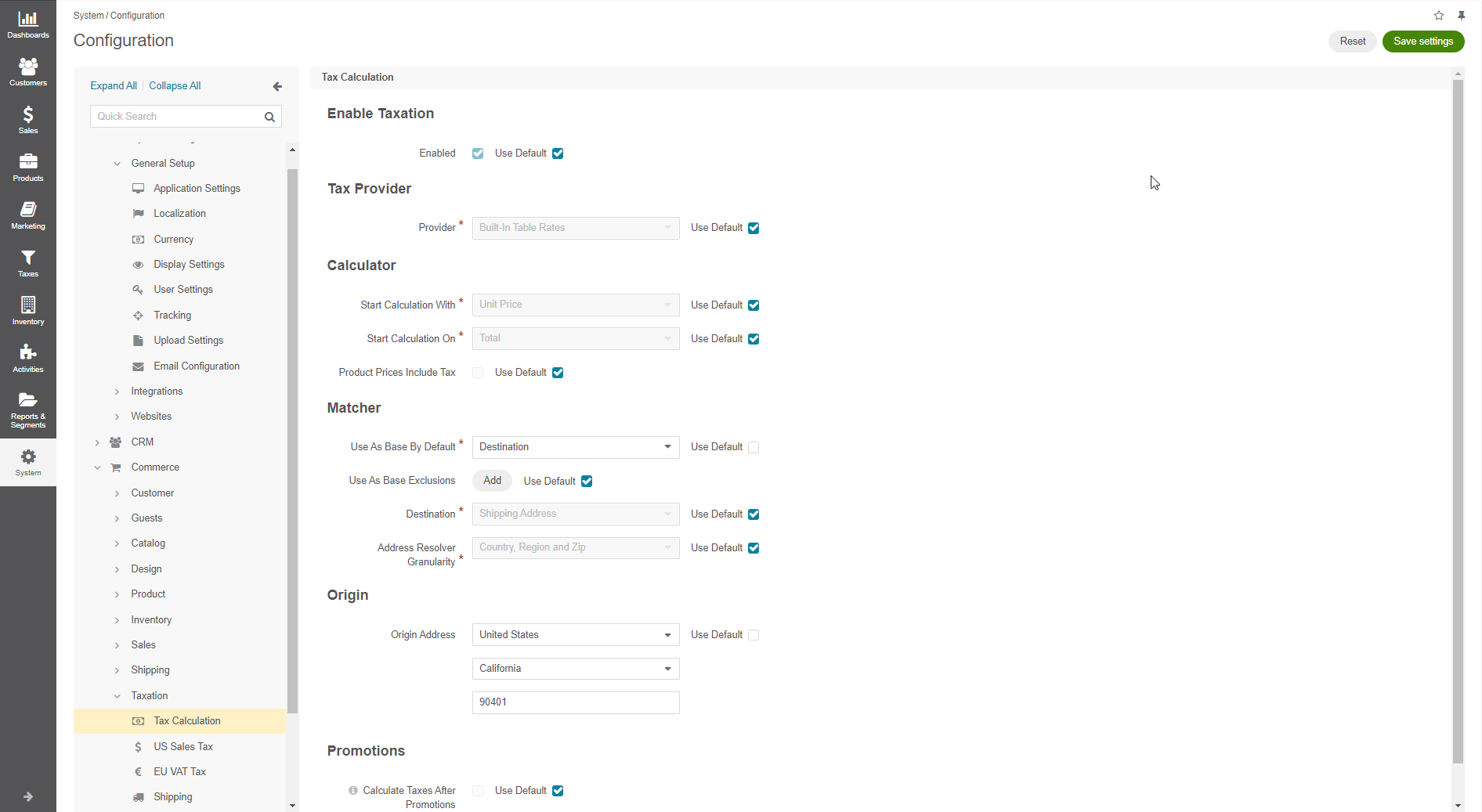

To customize the following tax calculation settings that impact the way OroCommerce implies tax to orders, perform the following steps:

Navigate to System > Configuration in the main menu.

Select Commerce > Taxation > Tax Calculation in the menu to the left.

Note

For faster navigation between the configuration menu sections, use Quick Search.

To customize the option configuration, clear the Use Default checkbox next to the option and select or type in the new option value.

Click Reset at the top right to roll back any changes to the tax calculation settings.

Click Save Settings to save the changes.

Enable Taxation

In the Enable Taxation section, enable or disable taxation by setting or clearing the Enabled box. Whenever you use the built-in or third-party tax provider, the taxation should be enabled.

Tax Provider

In the Tax Provider section, select the required tax provider. The Built-in Table Rates option is the default one that specifies that you use the OroCommerce tax management functionality. You can also use an external tax management and compliance system, like AvaTax or Vertex, as a tax provider with some customization. In this case, select your custom tax management system.

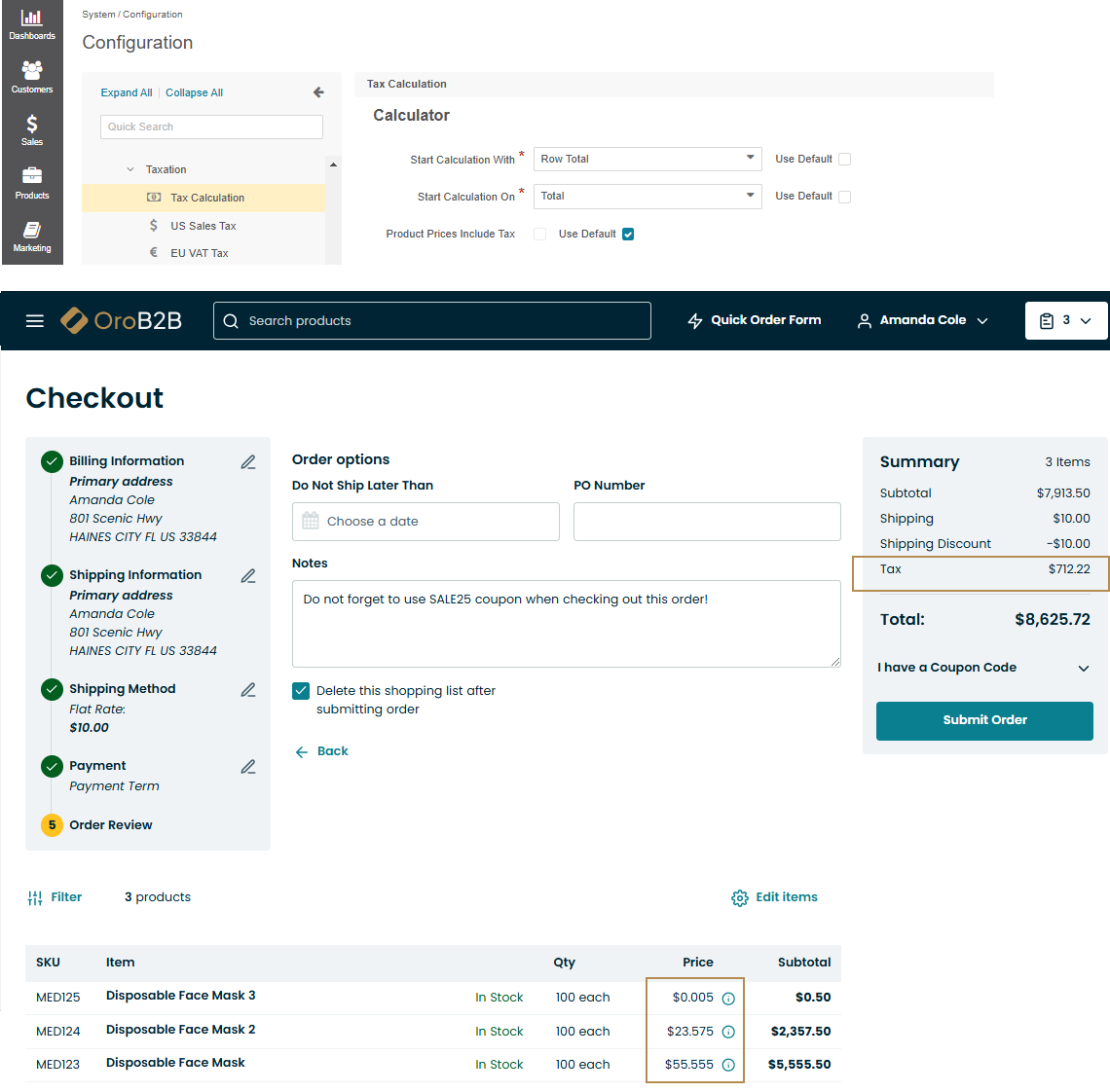

Tax Calculator

In the Calculator section, select whether to apply taxes to each individual item in the purchase order or to the total amount for items of the same kind. This approach helps minimize rounding errors and ensures accurate calculations, protecting both you and your customers from overpayment or underpayment.

Hint

For more information on price calculation precision and the different types of pricing rounding, refer to the Pricing Settings documentation.

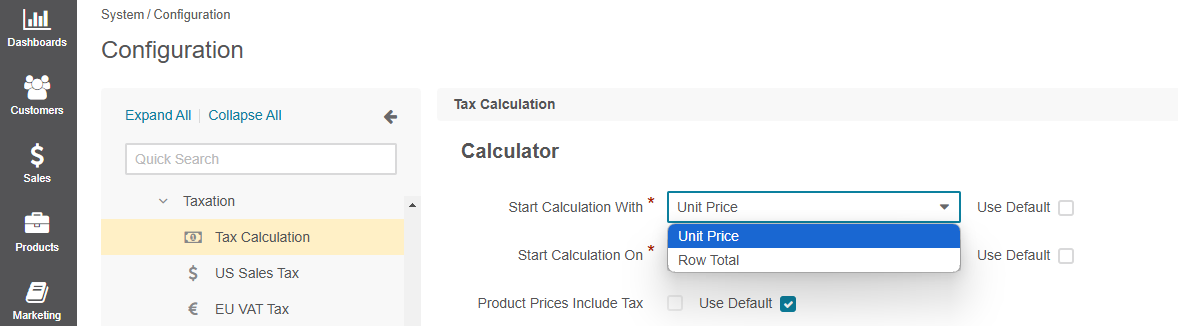

Start Calculation With

Start Calculation With - The option allows you to specify how taxes should be calculated — either per Unit Price or based on the Row Total (total price for all units of the same product).

Unit Price Formula — This setting calculates taxes at the unit level before summing them up for the entire order. It multiplies the rounded price of a single unit by the tax rate and then by the quantity. This method ensures that each unit’s tax is computed individually. The parentheses

()in the formula denote where rounding is applied.

|

Row Total Formula — This setting calculates taxes based on the row total (the total price for all units of the product) rather than the unit price. It first multiplies the unit price by the quantity to get the total price for that product, rounds the result based on the configuration and then applies the tax rate. The parentheses

()in the formula denote where rounding is applied.

|

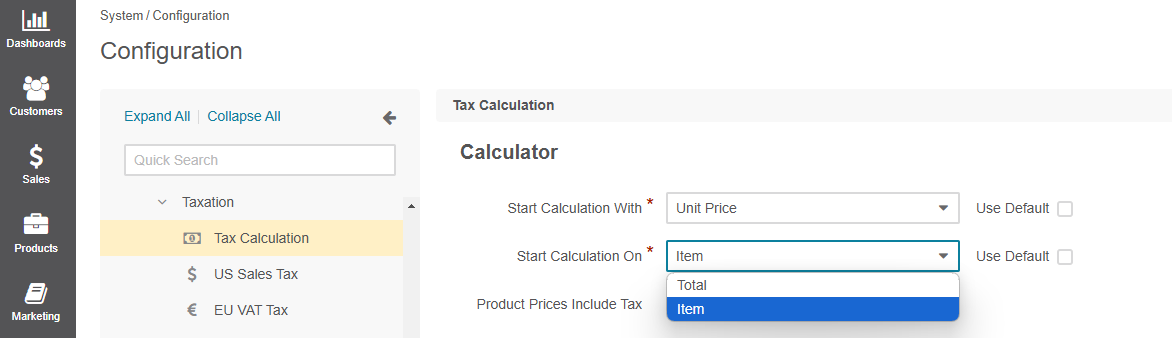

Start Calculation On

Start Calculation On — The option specifies when additional rounding is applied during the tax calculation process. For Item, the taxable amount is rounded up for every item individually and then summed up. For Total, the total tax is aggregated as is, and the final amount is rounded up.

Let’s illustrate the calculation and rounding logic using the following example:

Product |

Price |

Quantity |

Tax Rate |

Rounding Precision |

Pricing Rounding Type |

|---|---|---|---|---|---|

A |

$0.005 |

100 |

9% (0.09) |

2 decimal places |

Half Up |

B |

$23.575 |

100 |

9% (0.09) |

2 decimal places |

Half Up |

C |

$55.555 |

100 |

9% (0.09) |

2 decimal places |

Half Up |

Calculation Examples

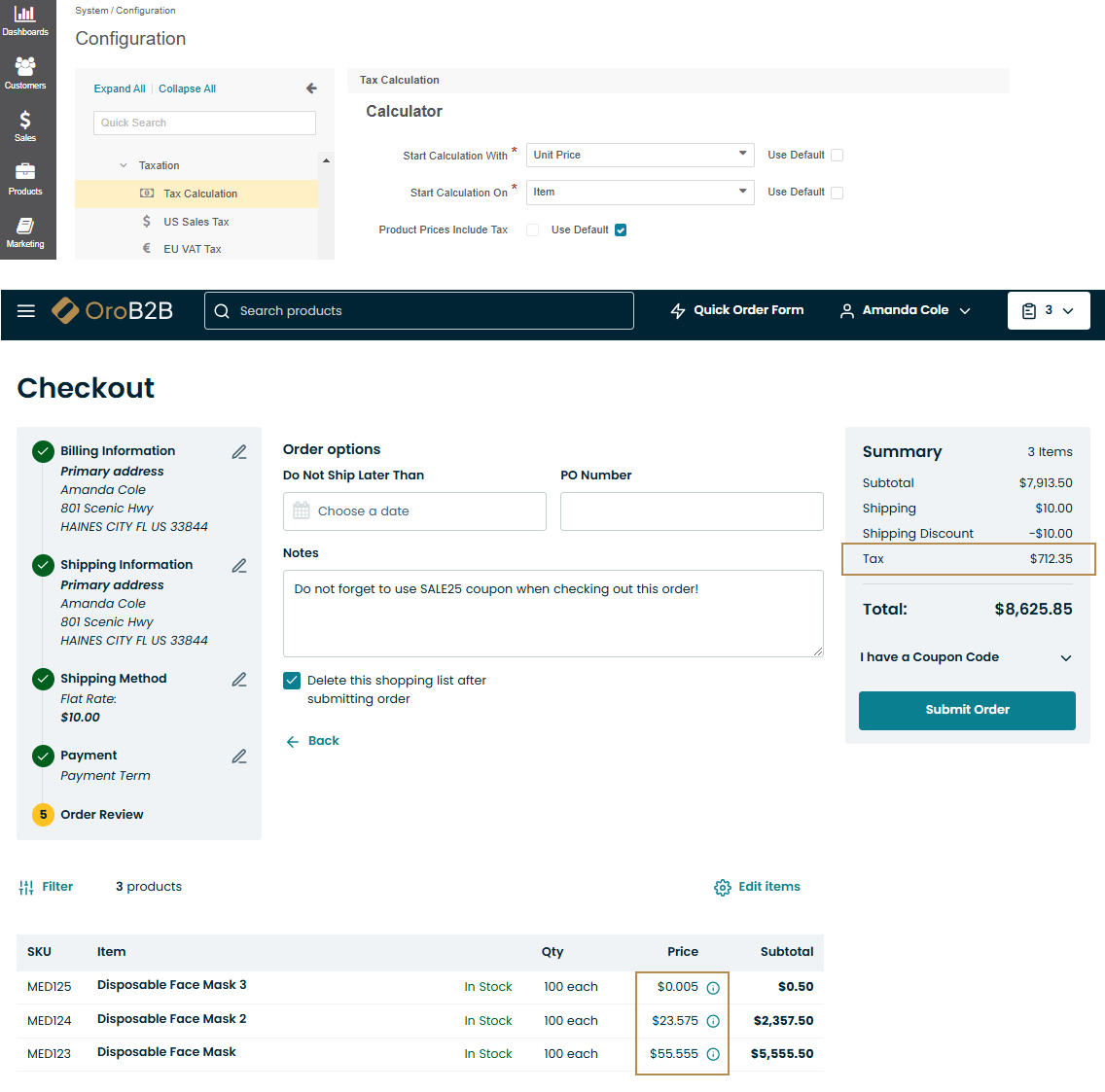

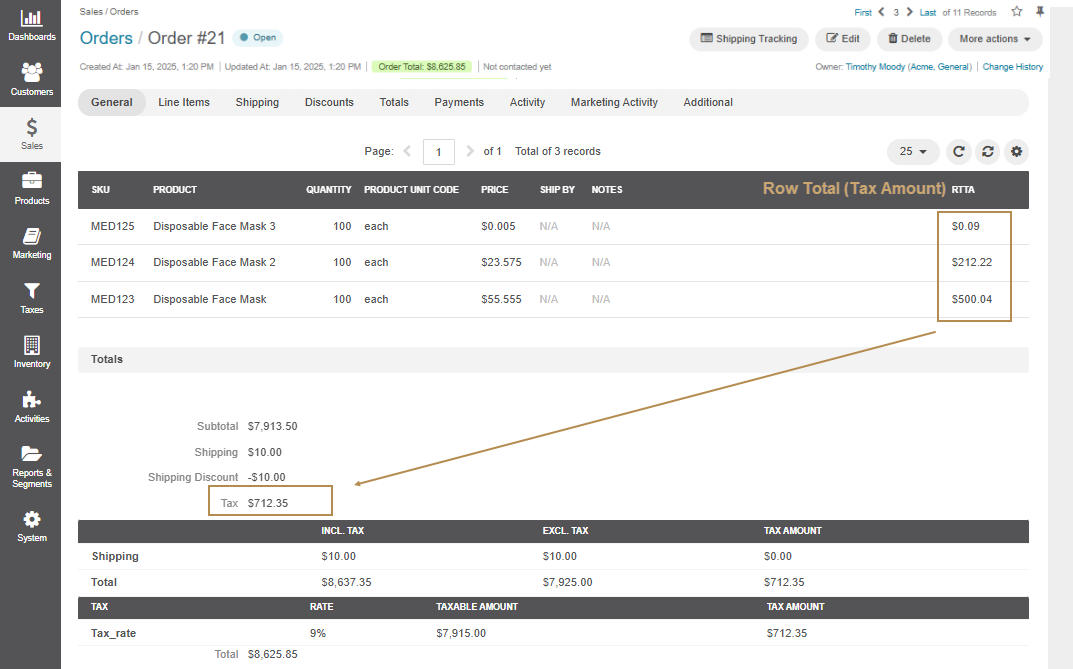

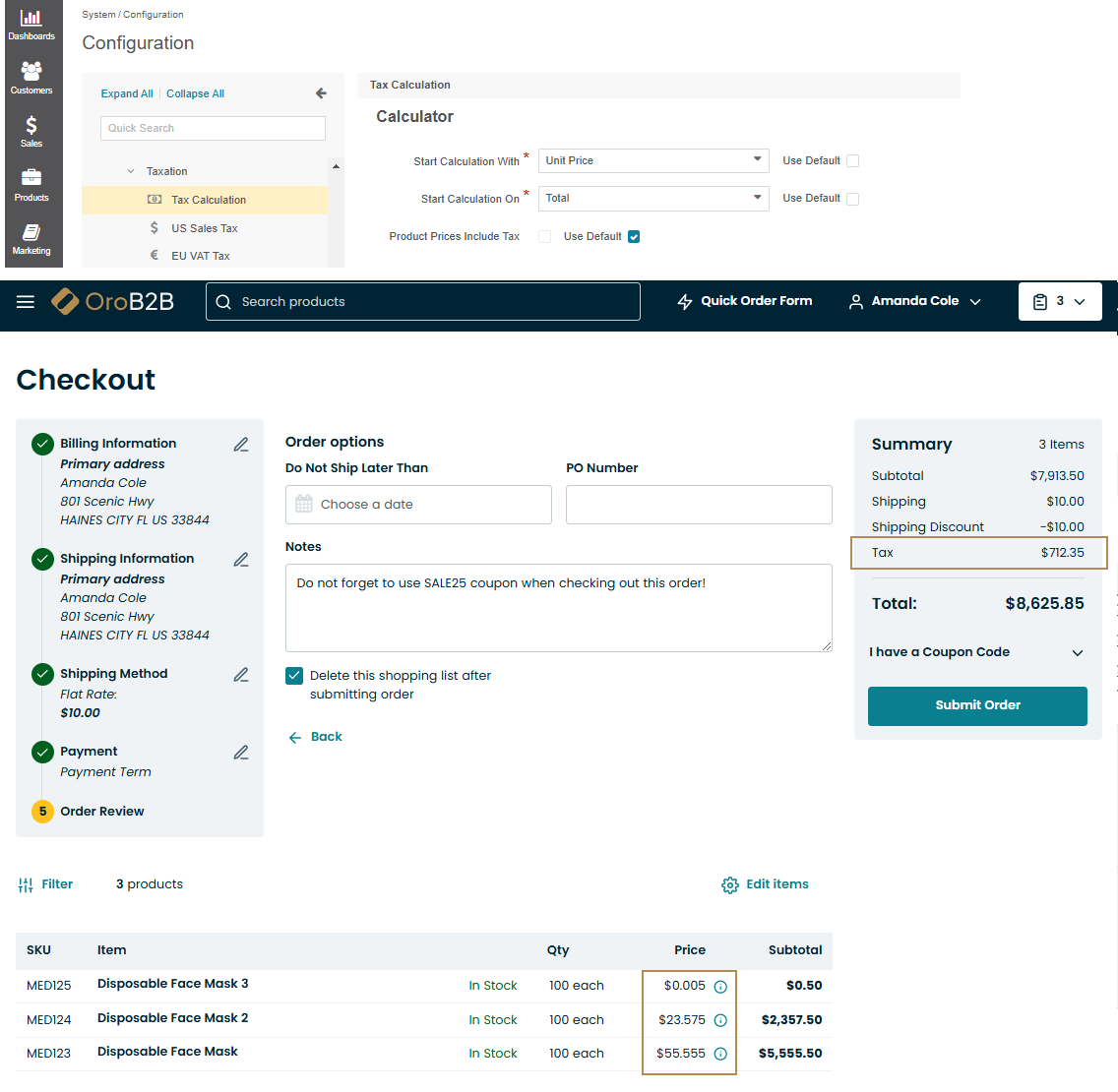

Example 1: Start Calculation With = Unit Price and Start Calculation On = Item

Tax is calculated for each unit of the product individually, rounded based on configuration, and then summed up to determine the total tax. The parentheses () in the formula denote where rounding is applied.

Unit Price Formula:

Total Tax = [((Unit Price) x Tax Rate x Unit Quantity)] + ... + [((Unit Price) x Tax Rate x Unit Quantity)]

* Tax per unit (Product A) = ((0.005) x 0.09 x 100) = (0.01 x 0.09 x 100) = (0.09) = 0.09

* Tax per unit (Product B) = ((23.575) x 0.09 x 100) = (23.58 x 0.09 x 100) = (212.22) = 212.22

* Tax per unit (Product C) = ((5.555) x 0.09 x 100) = (55.56 x 0.09 x 100) = (500.04) = 500.04

* Total Tax = 0.09 + 212.22 + 500.04 = 712.35

Hint

Keep in mind that in the back-office, tax amounts are always rounded to 2 decimal places, regardless of the tax calculation formula or price precision settings. This approach ensures compliance with regulations in many countries that require displaying taxes per unit. Additionally, since most jurisdictions mandate rounding for tax filings, small discrepancies may arise between the tax collected and the amount reported.

Example 2: Start Calculation With = Unit Price and Start Calculation On = Total

Tax is calculated for each unit of the product individually, summed up as is, and the final amount is rounded up. The parentheses () in the formula denote where rounding is applied.

Unit Price Formula:

Total Tax = ( [(Unit Price) x Tax Rate x Unit Quantity] + ... + [(Unit Price) x Tax Rate x Unit Quantity] )

* Tax per unit (Product A) = (0.005) x 0.09 x 100 = 0.01 x 0.09 x 100 = 0.09

* Tax per unit (Product B) = (23.575) x 0.09 x 100 = 23.58 x 0.09 x 100 = 212.22

* Tax per unit (Product C) = (5.555) x 0.09 x 100 = 55.56 x 0.09 x 100 = 500.04

* Total Tax = (0.09 + 212.22 + 500.04) = (712.35) = 712.35

Hint

Keep in mind that in the back-office, tax amounts are always rounded to 2 decimal places, regardless of the tax calculation formula or price precision settings. This approach ensures compliance with regulations in many countries that require displaying taxes per unit. Additionally, since most jurisdictions mandate rounding for tax filings, small discrepancies may arise between the tax collected and the amount reported.

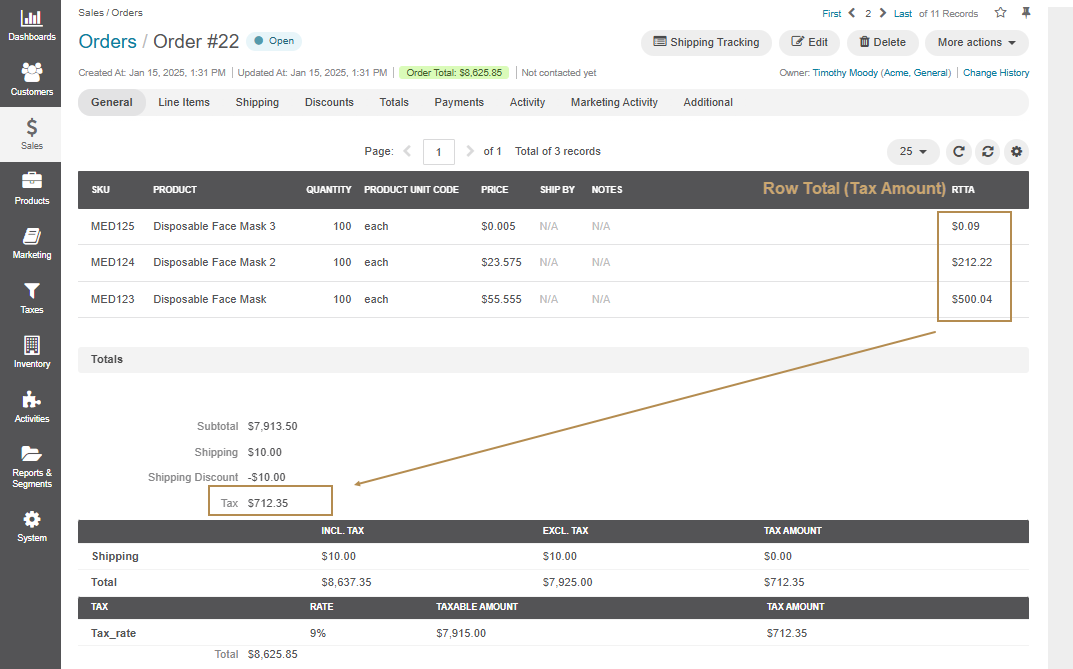

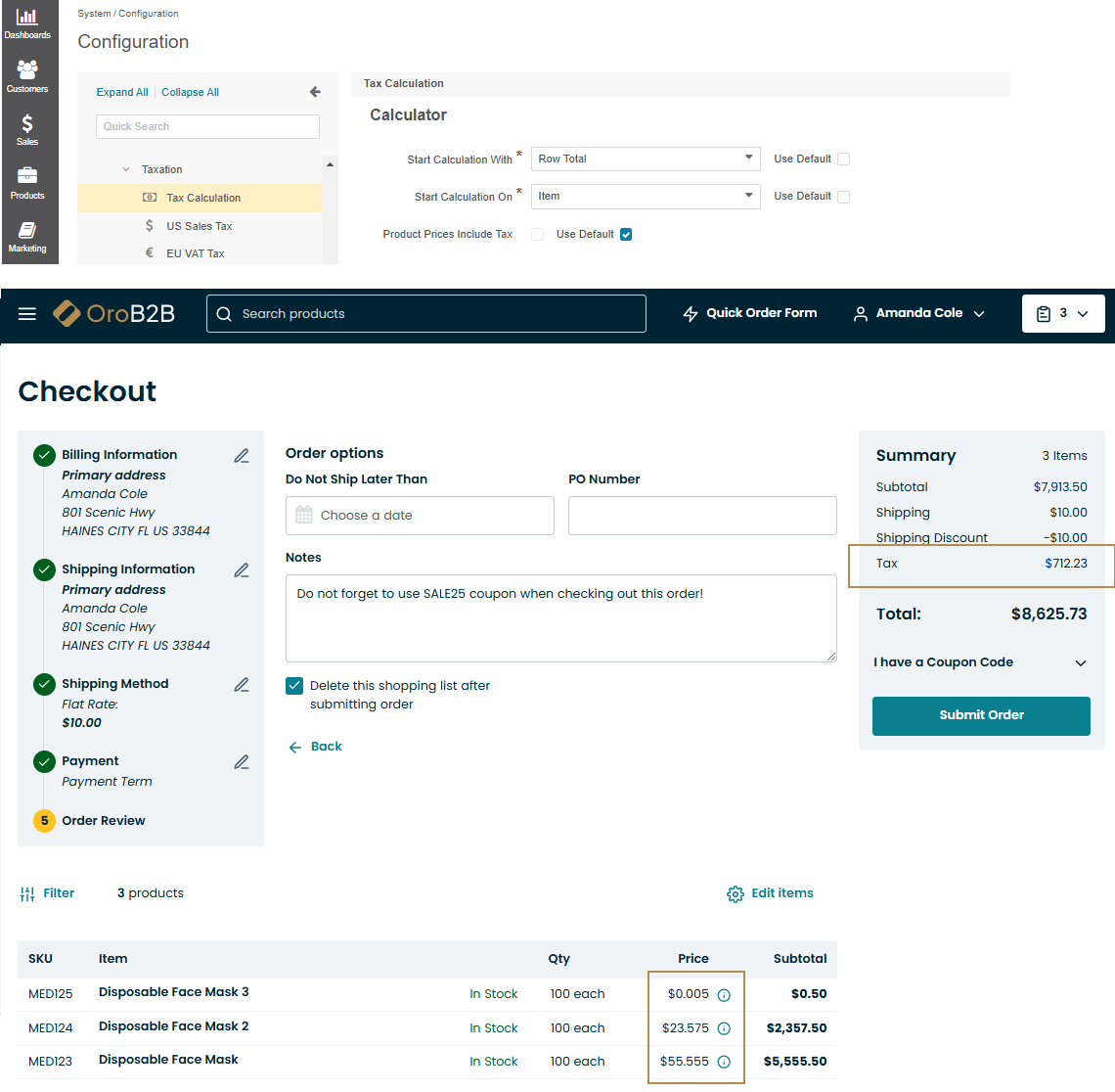

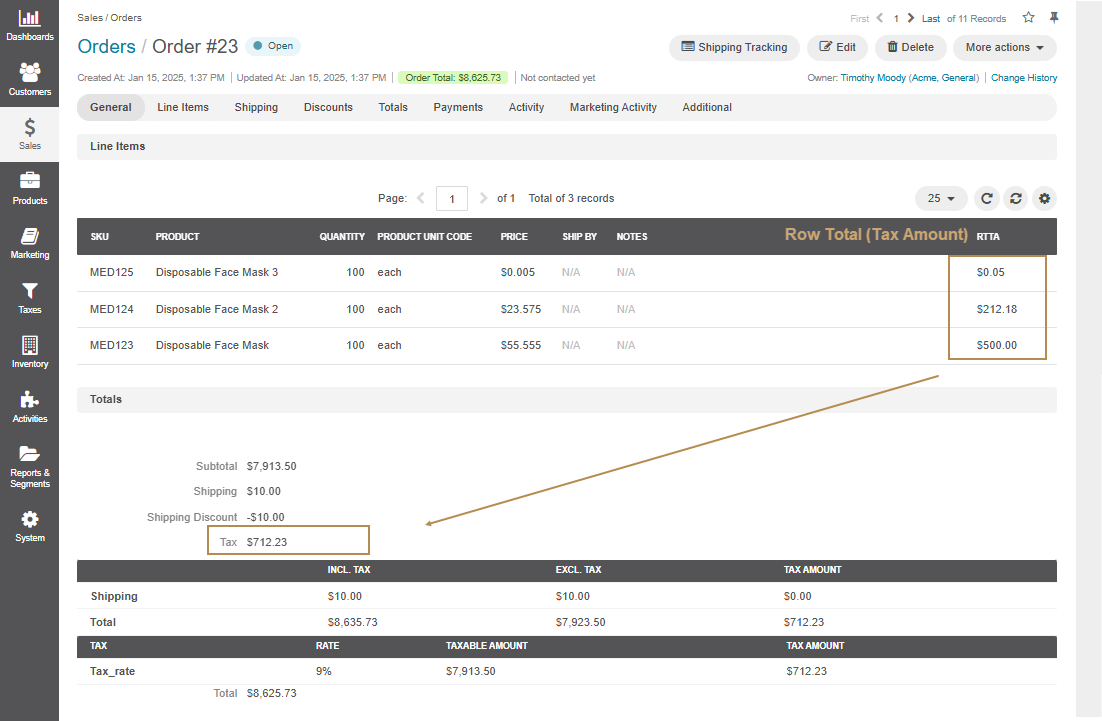

Example 3: Start Calculation With = Row Total and Start Calculation On = Item

Tax is calculated for the total row amount first, then the tax is applied to the entire amount. The tax is then rounded based on configuration and summed up to determine the total tax. The parentheses () in the formula denote where rounding is applied.

Row Total Formula:

Total Tax = [((Unit Price x Unit Quantity) x Tax Rate)] + ... + [((Unit Price x Unit Quantity) x Tax Rate)]

* Tax per unit (Product A) = ((0.005 x 100) x 0.09) = ((0.5) x 0.09) = (0.5 x 0.09) = (0.045) = 0.05

* Tax per unit (Product B) = ((23.575 x 100) x 0.09) = ((2357.5) x 0.09) = (2357.5 x 0.09) = (212.175) = 212.18

* Tax per unit (Product C) = ((55.555 x 100) x 0.09) = ((5555.5) x 0.09) = (5555.5 x 0.09) = (499.995) = 500

* Total Tax = 0.05 + 212.18 + 500 = 712.23

Hint

Keep in mind that in the back-office, tax amounts are always rounded to 2 decimal places, regardless of the tax calculation formula or price precision settings. This approach ensures compliance with regulations in many countries that require displaying taxes per unit. Additionally, since most jurisdictions mandate rounding for tax filings, small discrepancies may arise between the tax collected and the amount reported.

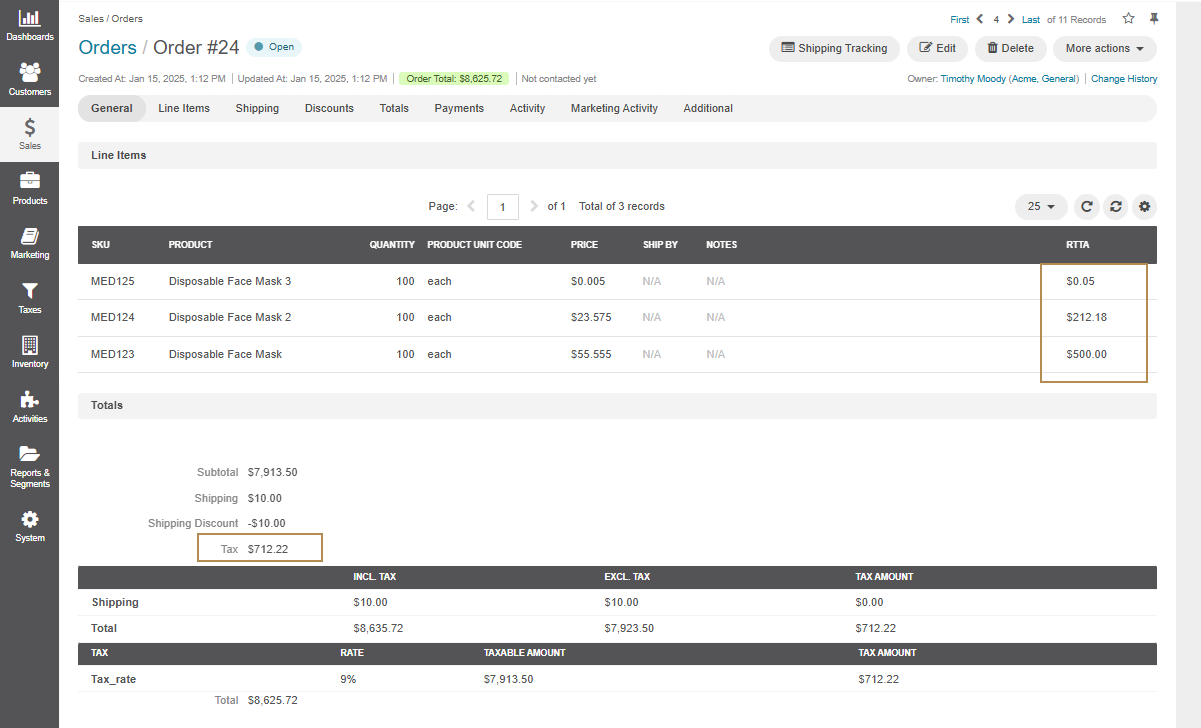

Example 4: Start Calculation With = Row Total and Start Calculation On = Total

Tax is calculated for the total row amount first, then the tax is applied to the entire amount, summed up as is, and the final amount is rounded up. The parentheses () in the formula denote where rounding is applied.

Row Total Formula:

Total Tax = ( [(Unit Price x Unit Quantity) x Tax Rate] + ... + [(Unit Price x Unit Quantity) x Tax Rate] )

* Tax per unit (Product A) = (0.005 x 100) x 0.09 = (0.5) x 0.09 = 0.5 x 0.09 = 0.045

* Tax per unit (Product B) = (23.575 x 100) x 0.09 = (2357.5) x 0.09 = 2357.5 x 0.09 = 212.175

* Tax per unit (Product C) = (55.555 x 100) x 0.09 = (5555.5) x 0.09 = 5555.5 x 0.09 = 499.995

* Total Tax = (0.045 + 212.175 + 499.995) = (712.215) = 712.22

Hint

Keep in mind that in the back-office, tax amounts are always rounded to 2 decimal places, regardless of the tax calculation formula or price precision settings. This approach ensures compliance with regulations in many countries that require displaying taxes per unit. Additionally, since most jurisdictions mandate rounding for tax filings, small discrepancies may arise between the tax collected and the amount reported.

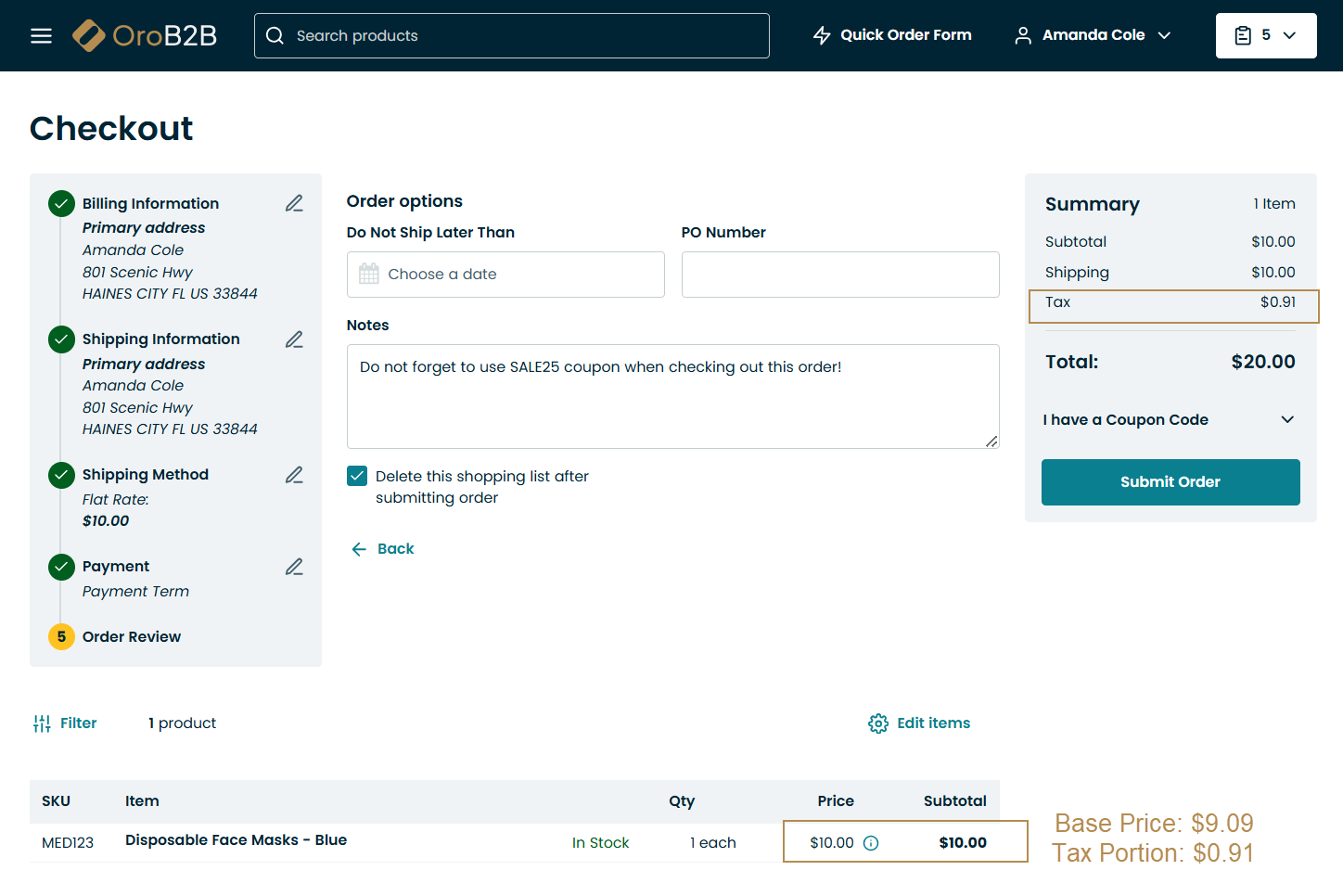

Product Prices Include Tax

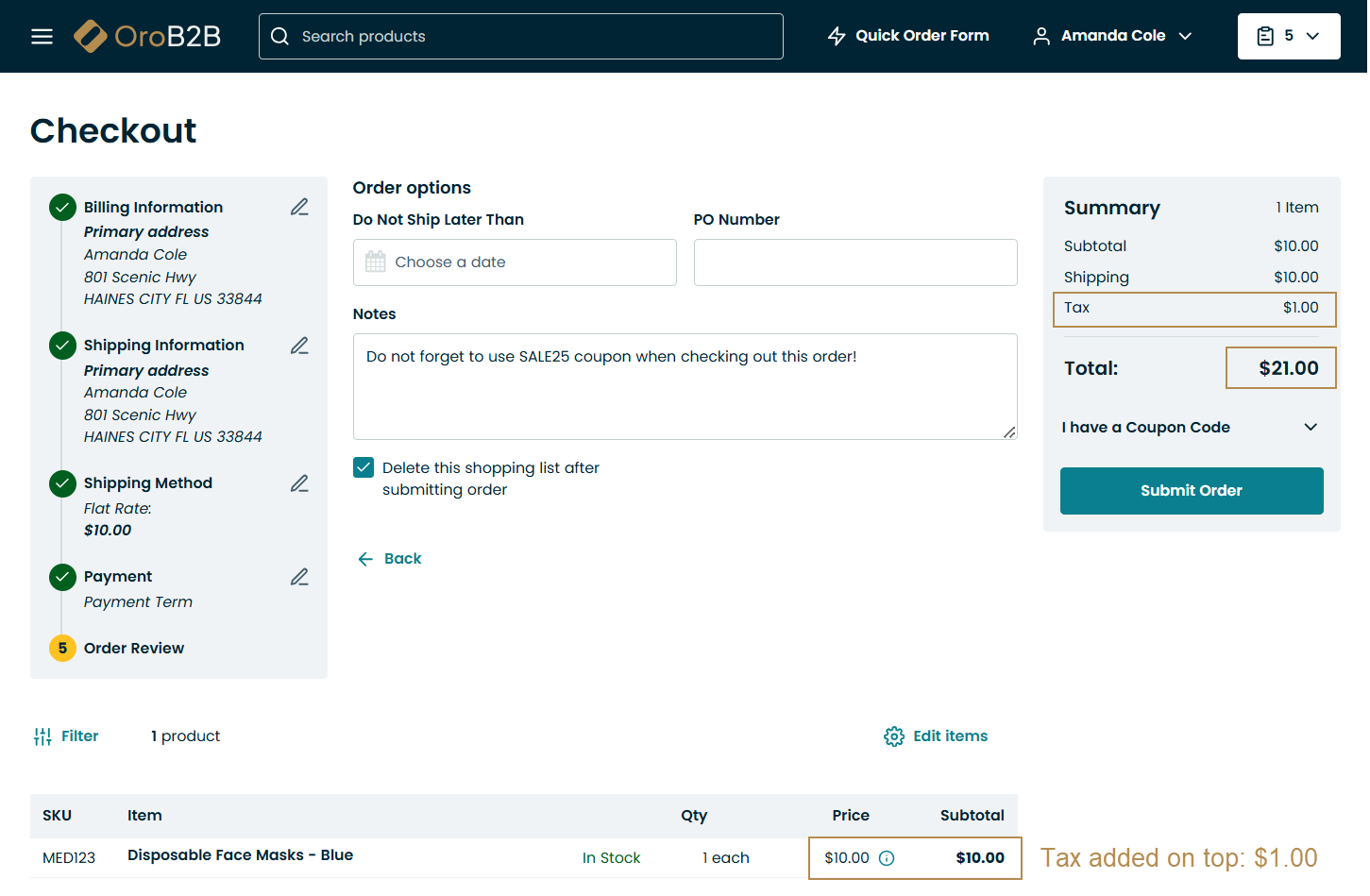

Product Prices Include Tax — The option determines whether taxes are already included in the product prices or need to be added on top. When product prices include tax, product prices displayed to customers already include the tax amount. During checkout, the system calculates the tax portion within the price and subtracts it from the unit, product, or total price. Otherwise, the tax is added on top of the unit, product, or total price.

Example 1: Product Prices Include Tax = True

To illustrate the tax portion calculation, let’s consider an example, where the product price is listed as $10.00, and the tax rate is 10% (0.1).

The formula to calculate the tax portion in a product price is:Tax Portion Formula: Tax = (Price Including Tax x Tax Rate) / (1 + Tax Rate)Base Price = Price Including Tax - Tax* Tax Portion (Product A) = (10 x 0.1) / (1 + 0.1) = 1 / 1.1 = 0.91 * Price Without Tax (Product A) = 10 - 0.91 = 9.09

The setting applies when you want to include the taxes to the product prices and display the final price to your customers when they browse the storefront. In this case, you have to create related price lists that would reflect the prices with taxes per each customer individually, depending on their local tax rates.

With this configuration, the tax is just displayed as a reference and is not charged twice.

Example 2: Product Prices Include Tax = False

When product prices do not include the tax amount, the tax is calculated and added on top during checkout based on the Start Calculation With and Start Calculation On settings described previously. In our case, the product price is listed as $10.00 (tax-excluded), and the tax rate is 10%; the tax is added on top, increasing the order total.

Note

See also the use cases in the Tax Management concept guide.

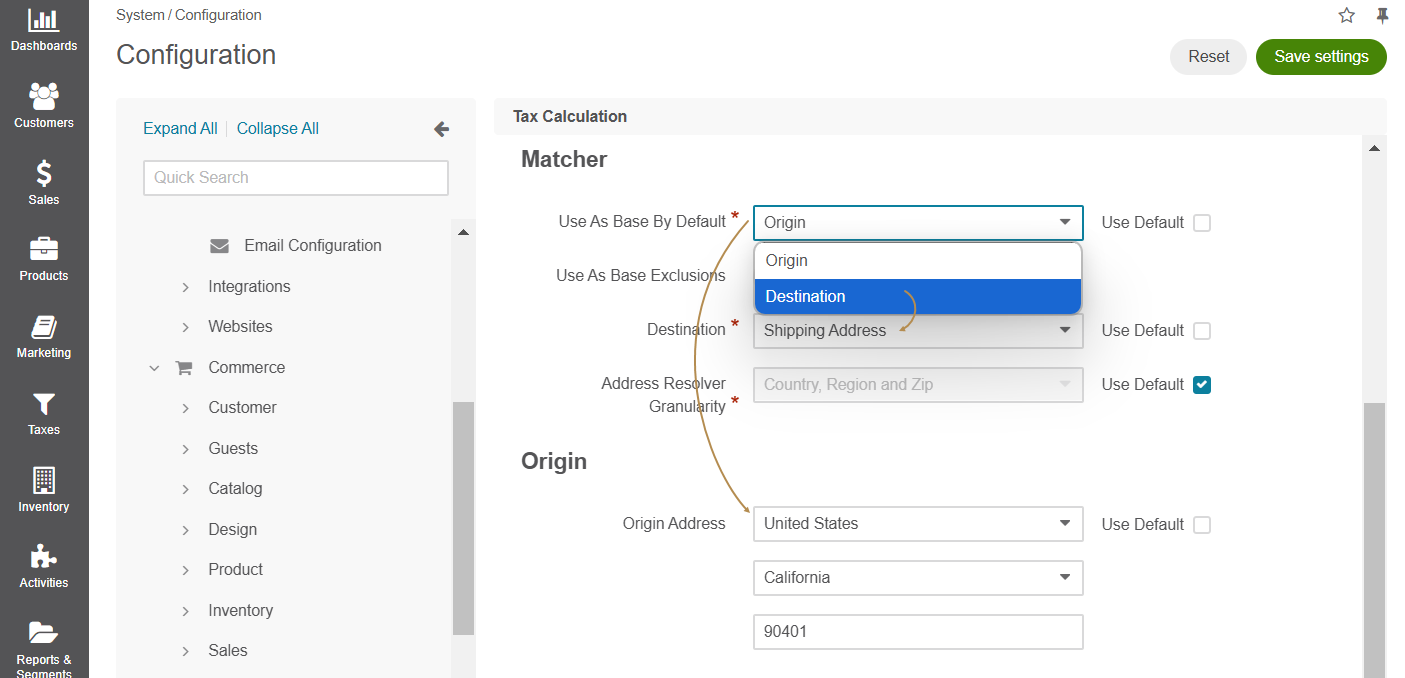

Matcher

In the Matcher section:

Configure how OroCommerce selects the core jurisdiction for which tax rules should be applied in a purchase order tax calculation. Tax jurisdiction may be defined by either shipping origin, billing address, or shipping destination for your home state:

For the origin-based jurisdiction, select Origin and define the default address in the Origin section below.

For the destination-based jurisdiction, select Destination and define whether to use the shipping address or billing as a reference for calculating the customer’s local tax rate in the Destination field.

Set up any tax jurisdiction exceptions - countries and states where tax jurisdiction selection deviates from the core rule. For example, when the main tax jurisdiction is at the sale shipping destination, the exception may be for some countries and states to use shipping origin instead. Click + Add, select a country, type in a state or a region, and select the alternative tax jurisdiction base.

If you use destination as tax jurisdiction base by default or for any exclusions, select either Shipping Address or Billing Address as Destination.

In the Address Resolver Granularity, define what information the tax resolver should consider when matching addresses against tax jurisdictions for the tax to be calculated properly and applied accordingly. There are several options:

Only Country — Tax jurisdiction should contain only country. The region and zip code fields should be empty, or no tax will be applied.

Only Country and Region — Tax jurisdiction should contain country and region. Zip code should be empty, otherwise no tax will be applied, even if the shipping address contains the country and region that match the tax jurisdiction.

Only Country and Zip — Tax jurisdiction should contain country and zip code. The region field is ignored even if it is mentioned in the address. Tax is applied anyway, regardless of whether region is defined or not.

Country, Region and Zip — Tax jurisdiction should contain all data (Country, Region, and Zip code) for the tax to be applied.

Origin

In the Origin section, provide the origin address (e.g. location of your warehouse or the company legal address) that will be used system-wide for origin-based tax. When the shipping origin is a core jurisdiction, OroCommerce will use the address provided here to find the matching built-in tax jurisdiction rules for tax calculation.

Promotions

In the Promotions section, select the Calculate Taxes After Promotions checkbox, if you wish to have your taxes calculated on the reduced price after the discounts are applied. If this option is disabled, taxes are calculated based on the full price before the discounts are applied. This configuration option is also available on the organization configuration level.

When a discount applies to the entire order, it is proportionally distributed among all items based on their subtotals. Tax is then calculated for each item after the discount is subtracted.

For example:

Line Item |

Line Item Subtotal |

Discount Amount |

Tax Rate |

Rounding Precision |

Pricing Rounding Type |

|---|---|---|---|---|---|

Product A |

$1000 |

$10 |

10% (0.1) |

2 decimal places |

Half Up |

Product B |

$100 |

$10 |

10% (0.1) |

2 decimal places |

Half Up |

Discount distribution among line items following the formula:

Line Item Discount = (Line Item Subtotal x Discount Amount) / Total Order Subtotal

* Product A discount amount = (1000 * 10) / (1000 + 100) = 10000 / 1100 = $9.09

* Product B discount amount = (100 * 10) / (1000 + 100) = 1000 / 1100 = $0.91Taxes per line item:

Line Item Tax = (Line Item Subtotal - Line Item Discount) x Tax Rate

* Tax for Product A: ($1000 - $9.09) * 0.1 = $99.091 = Round(99.091) = $99.09

* Taxable Product A tax: ($100 - $0.91) * 0.1 = $9.909 = Round(9.909) = $9.91

* Total tax amount after discounts: $99.09 + $9.91 = $109