Important

You are browsing documentation for version 5.1 of OroCommerce, supported until March 2027. Read the documentation for the latest LTS version to get up-to-date information.

See our Release Process documentation for more information on the currently supported and upcoming releases.

Configure Tax Calculation per Organization

Note

This Tax Calculation configuration option is also available on the global level.

You can control whether you want to calculate taxes before or after discounts are applied at the storefront checkout and when creating orders from the back-office:

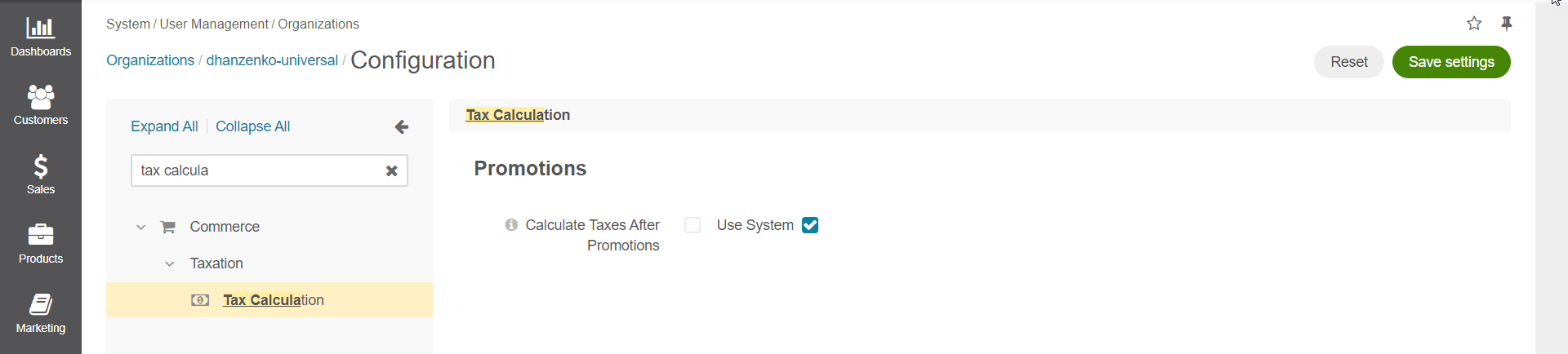

Navigate to System > User Management > Organizations in the main menu.

For the necessary organization, hover over the More Options menu to the right of the necessary organization and click to start editing the configuration.

Select Commerce > Taxation > Tax Calculation in the menu to the left.

Note

For faster navigation between the configuration menu sections, use Quick Search.

You can enable or disable the Calculate Taxes After Promotions option. Select the checkbox if you wish to have your taxes calculated on the reduced price after the discounts are applied. If this option is disabled, taxes are calculated based on the full price before the discounts are applied.

Note

When a discount applies to the entire order, it is proportionally distributed among all line items and subtracted from the subtotal of each of them. Tax is calculated for each taxable line item after that.

For example:

Line item 1 subtotal = 1000$

Line item 2 subtotal = 100$

Total discount amount = 10$

Tax = 10%

Discount distribution among all line items:

Line item 1 discount amount = (1000 * 10) / (1000 + 100) = 9.09$

Line item 2 discount amount = (100 * 10) / (1000 + 100) = 0.91$

Taxes for line items:

Taxable Line item 1 tax: (1000$ - 9.09$) * 0.1 = 99.091$

Taxable Line item 2 tax: (100$ - 0.91$) * 0.1 = 9.909$

Total tax amount after discounts: 99.091$ + 9.909$ = 109$

Click Save Settings.