Manage Customer Tax Codes in the Back-Office

Hint

This section is part of the Tax Management concept guide that provides a general understanding of the tax configuration and management in OroCommerce.

A customer tax code is a label assigned to a customer and indicates the tax obligations and exemptions a customer has. The customer tax obligations are considered when a customer (user) submits an order.

The sections below explain how to manage customer tax codes, using them to label customers and bind customers to dedicated tax rules.

Create a Customer Tax Code

A customer tax code is a label for a group of customers that indicates the tax obligations and exemptions that a customer has. These tax obligations are considered when a customer submits an order.

To create a new customer tax code:

Navigate to Taxes > Customer Tax Codes in the main menu.

Click Create Customer Tax Codes.

Fill in Owner, Code, and Description with information about the customer tax code you are creating.

Click Save and Close.

Manage Customer Tax Codes

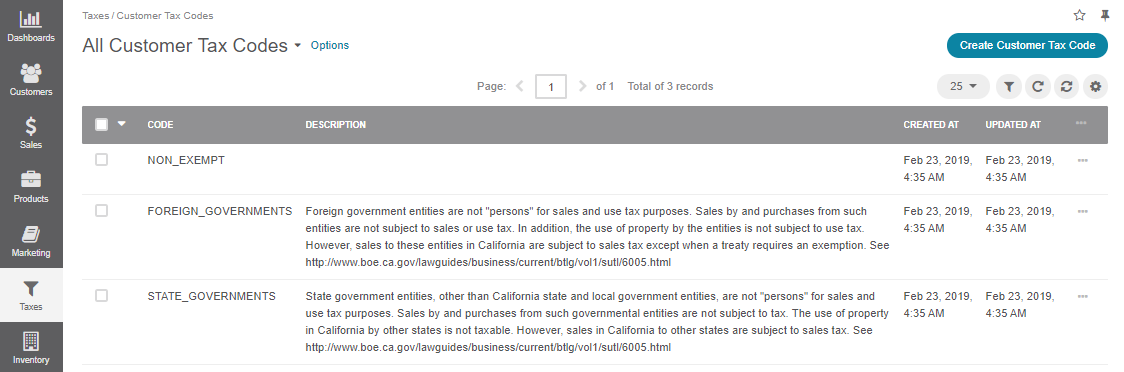

To view all customer tax codes, navigate to Taxes > Customer Tax Codes in the main menu.

Note

To handle a considerable volume of data, use the page switcher, increase View Per Page, or use filters to narrow down the list to just the codes you need.

In the customer tax codes list, you will find the information about the code (unique identifier), a detailed description, and the dates when the customer tax code was created and updated.

Hover over the More Options menu to the right of the item and click to open its details page, to edit, or to remove the customer tax code.

View Customer Tax Code Details

To view customer tax code details:

Navigate to Taxes > Customer Tax Codes in the main menu.

Find the line with the necessary customer tax code and click it to open its details.

You can perform the following actions with a customer tax code:

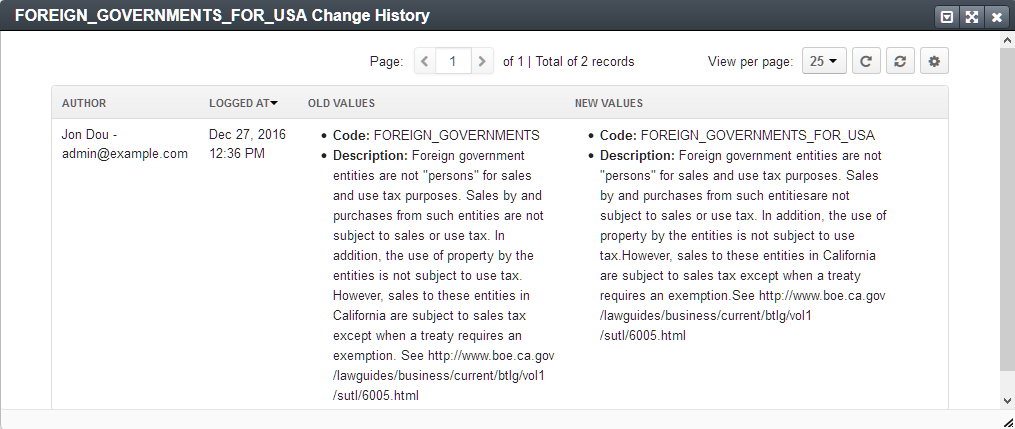

View Change History — See the log of edits of this customer tax code by clicking the Change History link to the top right of the page.

View details of the customer who is linked to this customer tax code — Click the line with the customer account details.

Edit or

Delete the selected customer tax code.

Note

You can edit the customer details to remove the link to this customer tax code, if necessary.

Edit Customer Tax Code Details

To edit the customer tax code value and description:

Navigate to Taxes > Customer Tax Codes in the main menu.

Hover over the More Options menu to the right of the item and click to start editing its details.

Update the Code and Description with new information about the customer tax code.

Click Save and Close.

Link a Tax Code to a Customer or a Customer Group

Customer

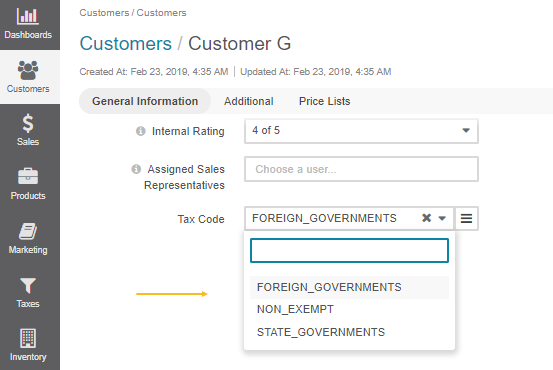

To link a tax code to a customer:

Navigate to the necessary customer and open it for editing (e.g., click Customers > Customers in the main menu, filter customers to find the one you need, hover over the More Options menu to the right of the item and click to start editing its details).

In the General section, select the tax code that matches the customer’s tax obligations in the Tax Code list.

Click Save and Close.

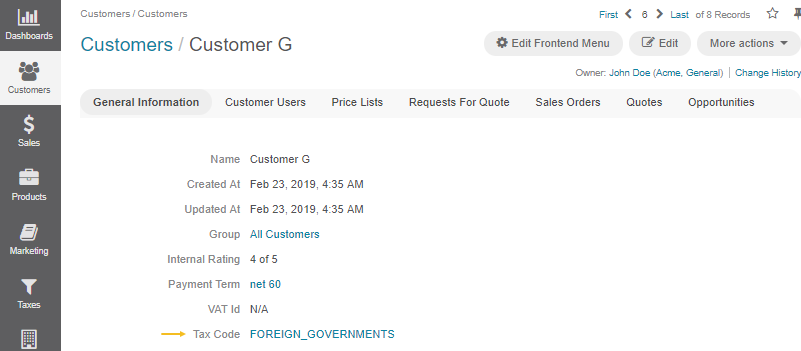

A clickable tax code link is now available in the customer details.

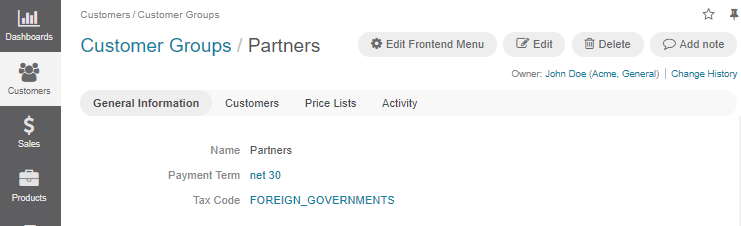

Customer Group

A tax code assigned to a customer group is by default applied to the customers in a group until they have the overriding tax association in their details.

To link a tax code to a customer group:

Navigate to the necessary customer group and open it for editing (e.g., click Customers > Customer Groups in the main menu, filter customer groups to find the one you need, hover over the More Options menu to the right of the item and click to start editing its details).

In the General section, in the Tax Code list, select the tax code that matches the customer group’s tax obligations.

Click Save and Close.

A clickable tax code link is now available in the customer and customer group details.

Link a Customer Tax Code to the Tax Rule

You can edit the association of the customer tax code with the tax when editing the tax rule details (see the respective topic for more information).

Related Articles