Important

You are browsing upcoming documentation for version 7.0 of OroCommerce, scheduled for release in 2026. Read the documentation for version 6.1 (the latest LTS version) to get up-to-date information.

See our Release Process documentation for more information on the currently supported and upcoming releases.

OroTaxBundle

OroTaxBundle introduces tax-related features in the OroCommerce application.

The bundle enables back-office users to create taxes, configure tax types for products, customers, and jurisdictions, as well as setup tax application rules based on the tax types.

With the corresponding configuration of the bundle, customers can view applied taxes for orders and quotes.

The bundle also provides an interface that enables developers to implement integrations with additional third-party tax providers to the OroCommerce applications.

Create Custom Tax Provider

You can add your own custom tax logic with custom tax provider.

Create tax provider that implements TaxProviderInterface interface:

namespace Acme\Bundle\DemoBundle\Provider;

use Oro\Bundle\TaxBundle\Provider\TaxProviderInterface;

class DemoTaxProvider implements TaxProviderInterface

{

const LABEL = 'acme.demo.providers.demo.label';

#[\Override]

public function getLabel()

{

return self::LABEL;

}

#[\Override]

public function isApplicable()

{

return true;

}

#[\Override]

public function loadTax($object)

{

// implement your loadTax() method.

}

#[\Override]

public function getTax($object)

{

// implement your getTax() method.

}

#[\Override]

public function saveTax($object)

{

// implement your saveTax() method.

}

#[\Override]

public function removeTax($object)

{

// implement your removeTax() method.

}

}

Register your own tax provider in the service container using the

oro_tax.tax_providertag with thealiasattribute that contains a unique name of the tax provider:

services:

acme_demo.tax_provider.demo:

class: Acme\Bundle\DemoBundle\Provider\DemoTaxProvider

tags:

- { name: oro_tax.tax_provider, alias: demo, priority: 10 }

Navigate to the admin panel under System > Configuration > Commerce > Taxation > Tax Calculation and chose your own custom Tax Provider in the dropdown list.

Calculate Taxes for Product Kits

Typically, the total tax is calculated by adding up the taxes for each individual order line item. In terms of product kits, which can aggregate several products in the set, the taxes should be applied to each product kit line item. However, not all products within the set are taxable. In such cases, taxes need to be calculated individually for each product.

Let’s consider the following cases for a product kit:

product kit `KIT` - $3000

kit item 1 `SIMPLE 1` - $100

kit item 2 `SIMPLE 2` - $200

The tax for the KIT and SIMPLE 1 products is 10%. The SIMPLE 2 product is exempt from tax.

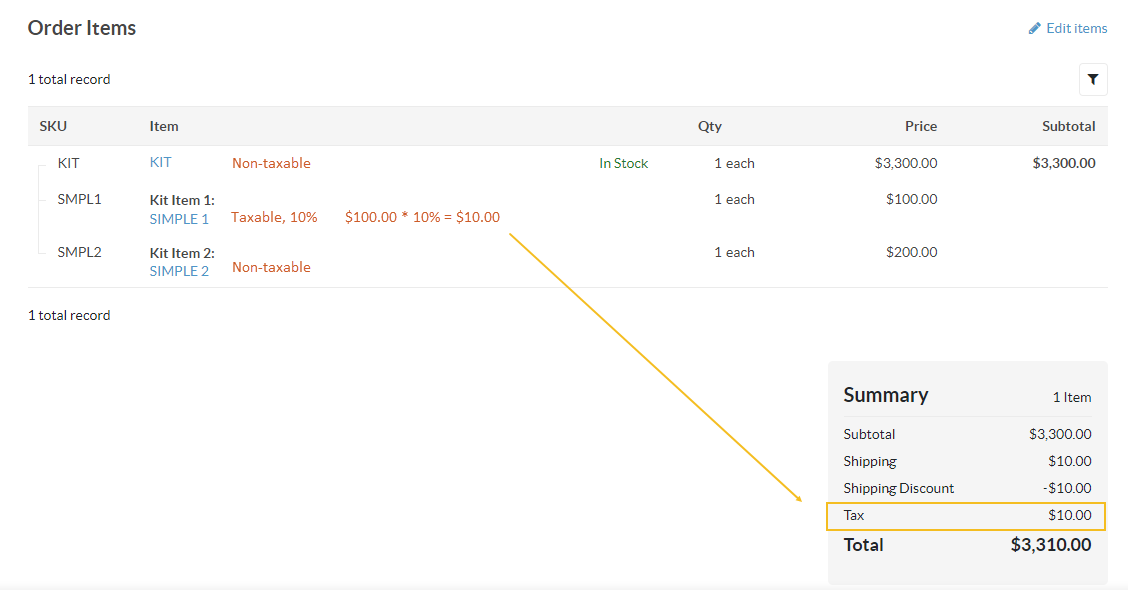

The 10% tax is applied to the SIMPLE 1 product only.

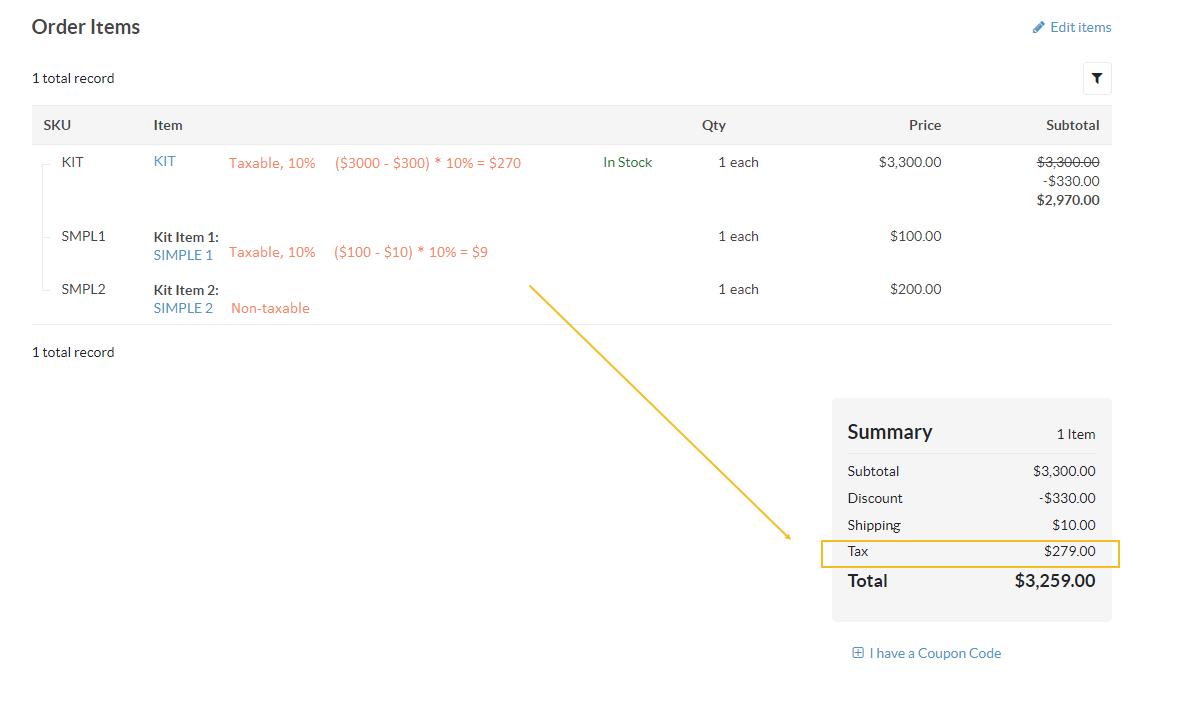

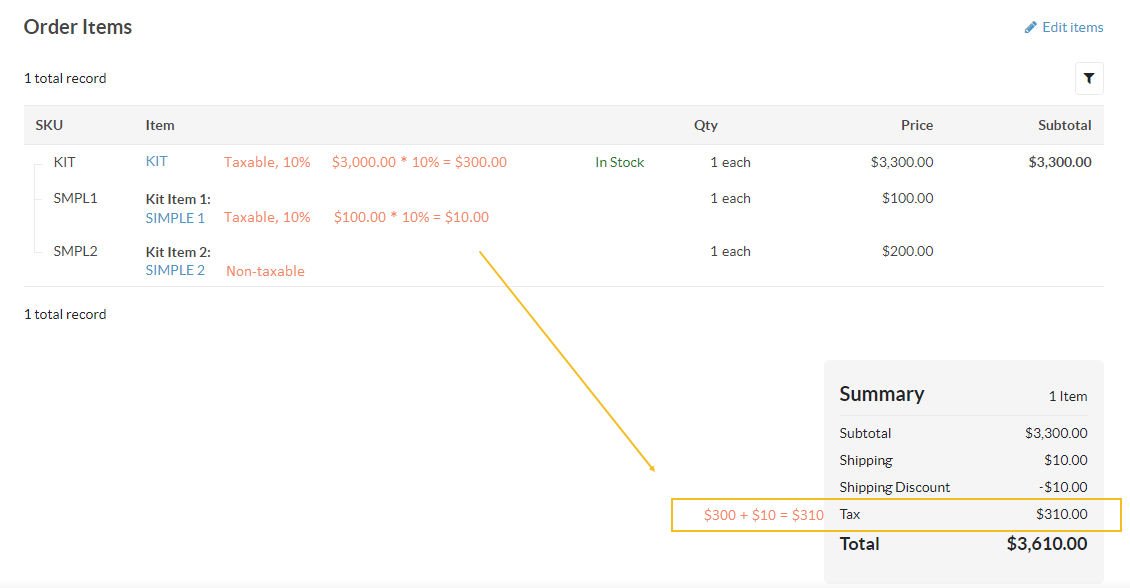

The 10% tax is applied to the KIT and SIMPLE 1 products. Additionally, there is a promotion discount of 10% for order line item. There are two options available for tax calculation depending on the Calculate Taxes After Promotions configuration status, which you can set under System Configuration > Commerce > Taxation > Tax Calculation in the back-office. When the option is enabled, the taxes are calculated on the reduced price after the discounts are applied. If this option is disabled, the taxes are calculated based on the full price before the discounts are applied.

When calculating taxes after promotions for a product kit, you need to distribute its discounts subtotal proportionally between the product kit subtotal.

For instance,

product kit `KIT` - $3000, taxable

kit item 1 `SIMPLE 1` - $100, taxable

kit item 2 `SIMPLE 2` - $200, non-taxable

$3300 subtotal

- 10% promotion discount ($330, all products are eligible for the discount)

+ 10% tax (KIT and SIMPLE 1)

taxes before promotions: $3000*10% + $100*10% = $300 + $10 = $310

taxes after promotions: ($3000-$300)*10% + ($100-$10)*10% = $270 + $9 = $279