Important

You are browsing documentation for version 5.0 of OroCommerce. Support of this version ended in January 2025. Read the documentation for version 6.1 (the latest LTS version) to get up-to-date information.

See our Release Process documentation for more information on the currently supported and upcoming releases.

Create a Tax Rule

Note

See a short demo on how to create tax rules in OroCommerce or keep reading the step-by-step guidance below.

To create tax rules for a particular tax jurisdiction, you need to complete the configuration of the tax options described in the Tax Rule Prerequisites section.

Once all the necessary actions are performed, you need to create a tax rule for every valid combination of the tax rates, product types, and customer types to ensure that they are properly taxed at every checkout.

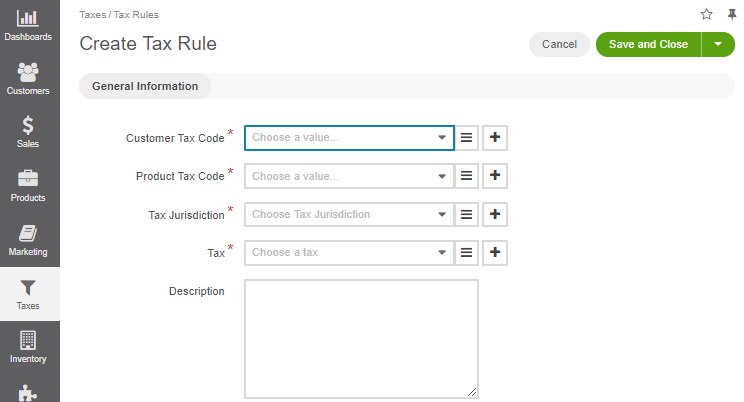

Navigate to Taxes > Tax Rules and click Create Tax Rule.

Select a customer and a product tax codes in the respective fields.

Select a tax jurisdiction in the Tax Jurisdiction field and a tax rate in the Tax field.

Describe this tax rule if necessary in the Description field.

Click Save and Close.

Related Articles