Important

You are browsing upcoming documentation for version 6.1 of OroCommerce, scheduled for release in 2025. Read the documentation for version 6.0 (the latest LTS version) to get up-to-date information.

See our Release Process documentation for more information on the currently supported and upcoming releases.

Import Taxes Rates

Hint

This section is part of the Data Import concept guide topic that provides guidelines on import operations in Oro applications.

Import File option helps import a large bulk of tax information into the tax list using the .csv file.

Example of tax bulk import template

Code |

Description |

Rate |

|---|---|---|

LOS_ANGELES_COUNTY_SALES_TAX |

Sales Tax |

0.09 |

To import a bulk of tax information:

In the main menu, navigate to Taxes > Taxes. The tax list opens.

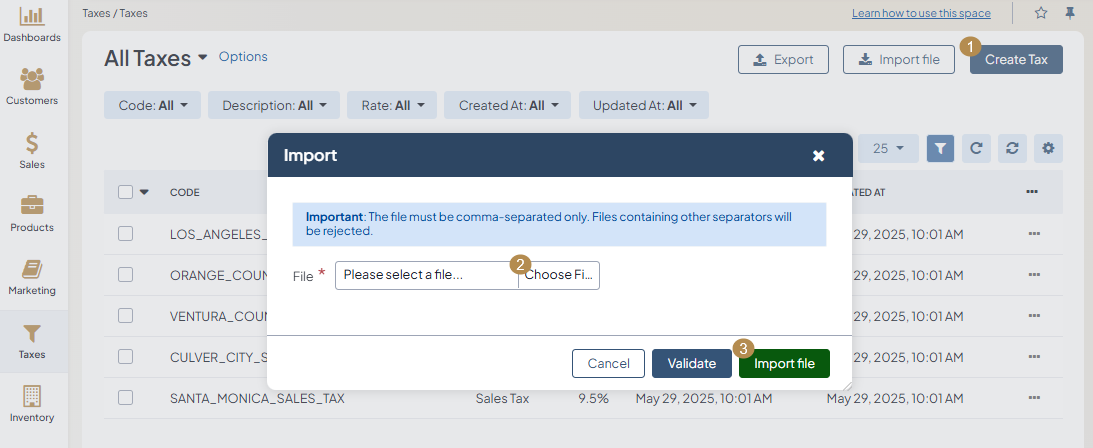

Click Import File on the top right.

Prepare data for import: Create your bulk information in the .csv format. Once your file is ready, click Choose File, select the prepared comma-separated values (.csv) file, and click Import File.

Note

Ensure that your .csv file is saved in the Unicode (UTF-8) encoding. Otherwise, the content of the file can be rendered improperly.

Validate import results: Click Validate to check your import results. If there are any Records with errors, fix them in the .csv file before starting the import.

Launch import: After successful validation, click Import File.

Click Cancel to decline the import.

Important

Interactive status messages inform about the import progress, and once the import is complete, the changes are reflected in the list upon refresh. Additionally, an email message with the import status is delivered to your mailbox.

Follow the on-screen guidance for any additional actions. For example, for the inventory template, select one of the options: a) inventory statuses only or b) detailed inventory levels.