Important

We are updating the images for OroCommerce version 6.1 to align with the latest changes in the back-office design. During this transition, some images may still show older versions. Thank you for your patience as we work to update all visuals to reflect these changes.

Configure Global Settings for US Sales Tax (Digital Products)

Hint

This section is part of the Tax Management concept guide that provides a general understanding of the tax configuration and management in OroCommerce.

When the digital product is purchased from the shipping origin address in the state with zero tax rate for digital products, the tax is calculated based on the shipping destination, and the global system tax calculation rules are ignored.

Note

To ensure that the US sales tax for digital products is correctly calculated and included in your purchase quotes and orders when you sell to the US customers or from the US warehouse, label the necessary digital product tax codes in OroCommerce as taxable in the US.

To label digital product codes in OroCommerce as taxable in the US:

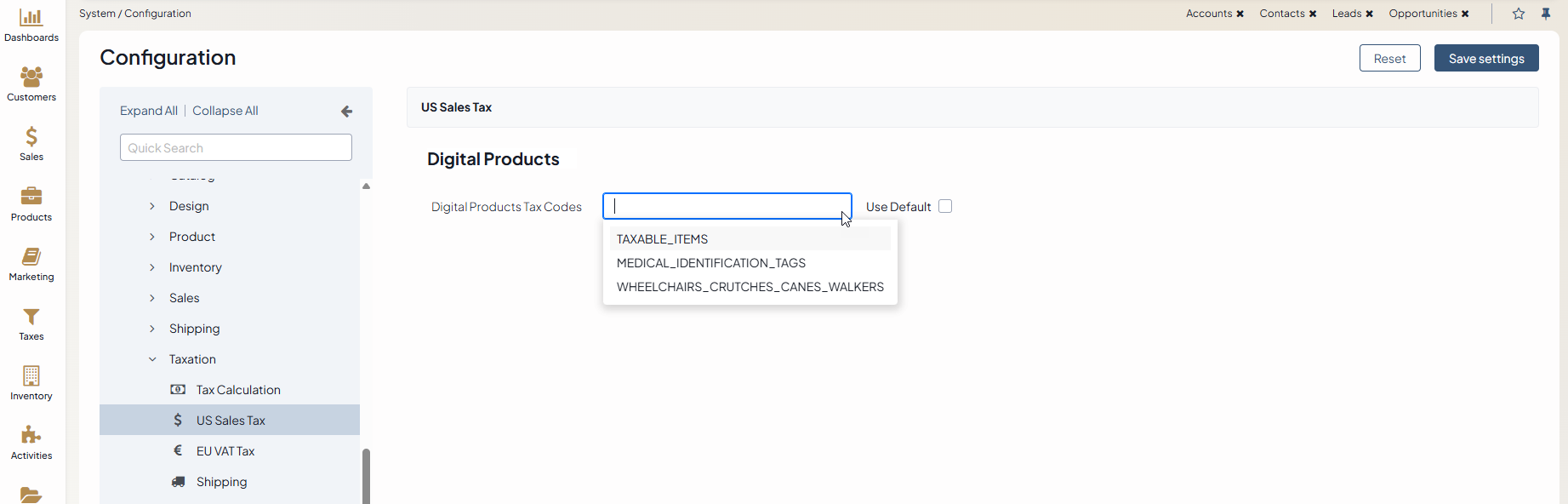

Navigate to System > Configuration > Commerce > Taxation > US Sales Tax.

Note

For faster navigation between the configuration menu sections, use Quick Search.

Clear the Use Default checkbox and click Choose the value. To filter the list of product tax codes, start typing the code name. The list refreshes automatically to show the values matching the text you enter. Once the necessary product code is found, select it to add to the Digital Products Tax Codes list.

Click Save.